UK Furniture Logistics in 2026: Challenges and Solutions

)

The logistics landscape for UK furniture in 2026 is being redrawn. Efficiency, speed, and sustainability now sit at the heart of competitiveness, and those who master logistics are fast becoming the industry’s real winners. Faster delivery, lower costs, smarter planning, and a stronger customer experience are the prizes on offer for businesses ready to rethink how products move from concept to consumer.

The pressures are mounting: ongoing skills shortages, supply chain volatility, and higher transport costs are colliding with new sustainability targets. The latest 2026 environmental standards on freight and warehousing have pushed logistics firmly onto the boardroom agenda. Meanwhile, real-time visibility is becoming the norm, nearly 60% of UK furniture deliveries are now tracked digitally, and the top-performing firms are cutting fulfilment costs by up to 25% through automation and data-led planning.

The pressures are mounting: ongoing skills shortages, supply chain volatility, and higher transport costs are colliding with new sustainability targets. The latest 2026 environmental standards on freight and warehousing have pushed logistics firmly onto the boardroom agenda. Meanwhile, real-time visibility is becoming the norm, nearly 60% of UK furniture deliveries are now tracked digitally, and the top-performing firms are cutting fulfilment costs by up to 25% through automation and data-led planning.

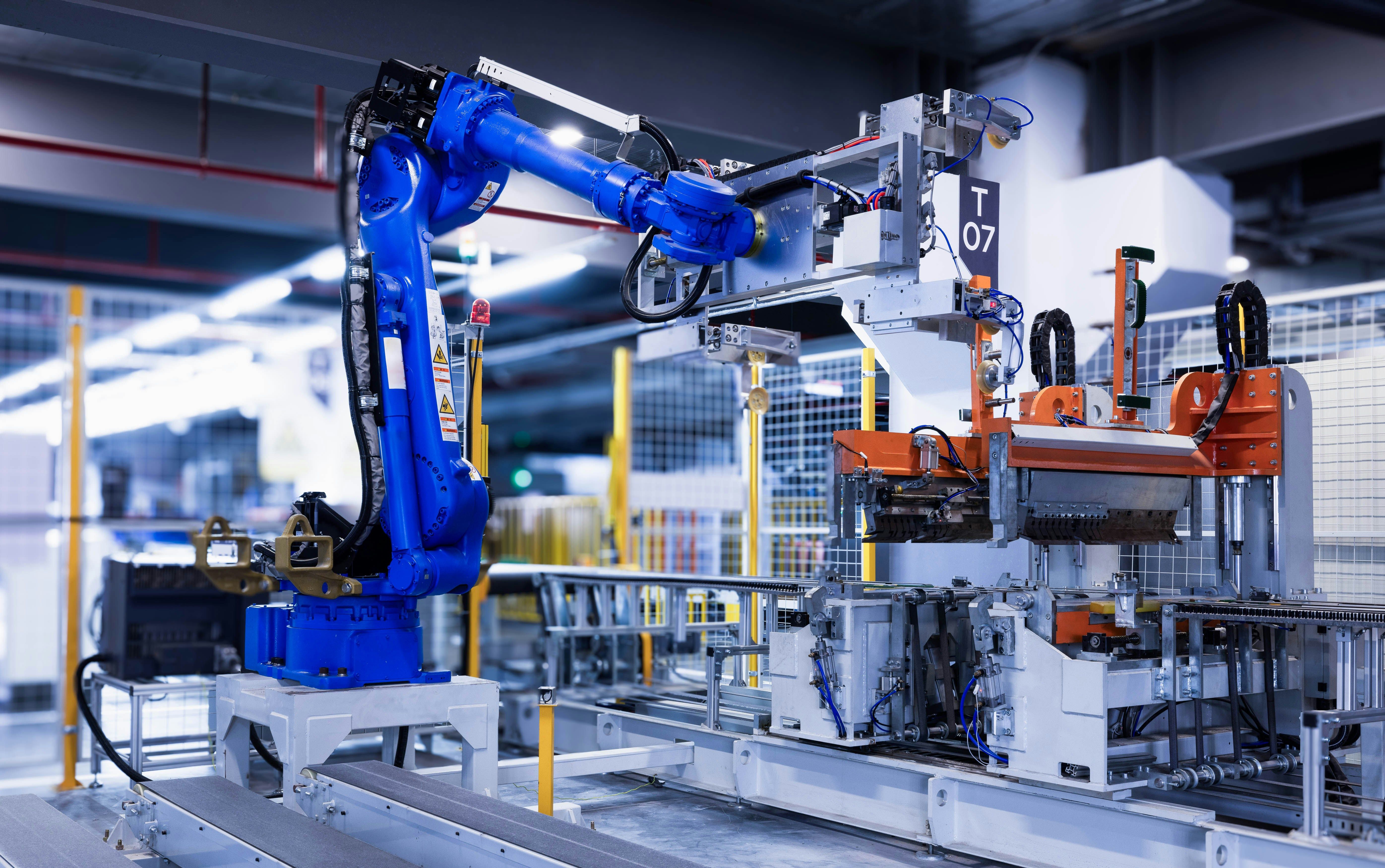

As the sector doubles down on technology, investment in digital management platforms, robotics, and low-carbon transport is accelerating. But the competition for skilled logistics talent remains fierce, and businesses are racing to align people, processes, and platforms for greater resilience.

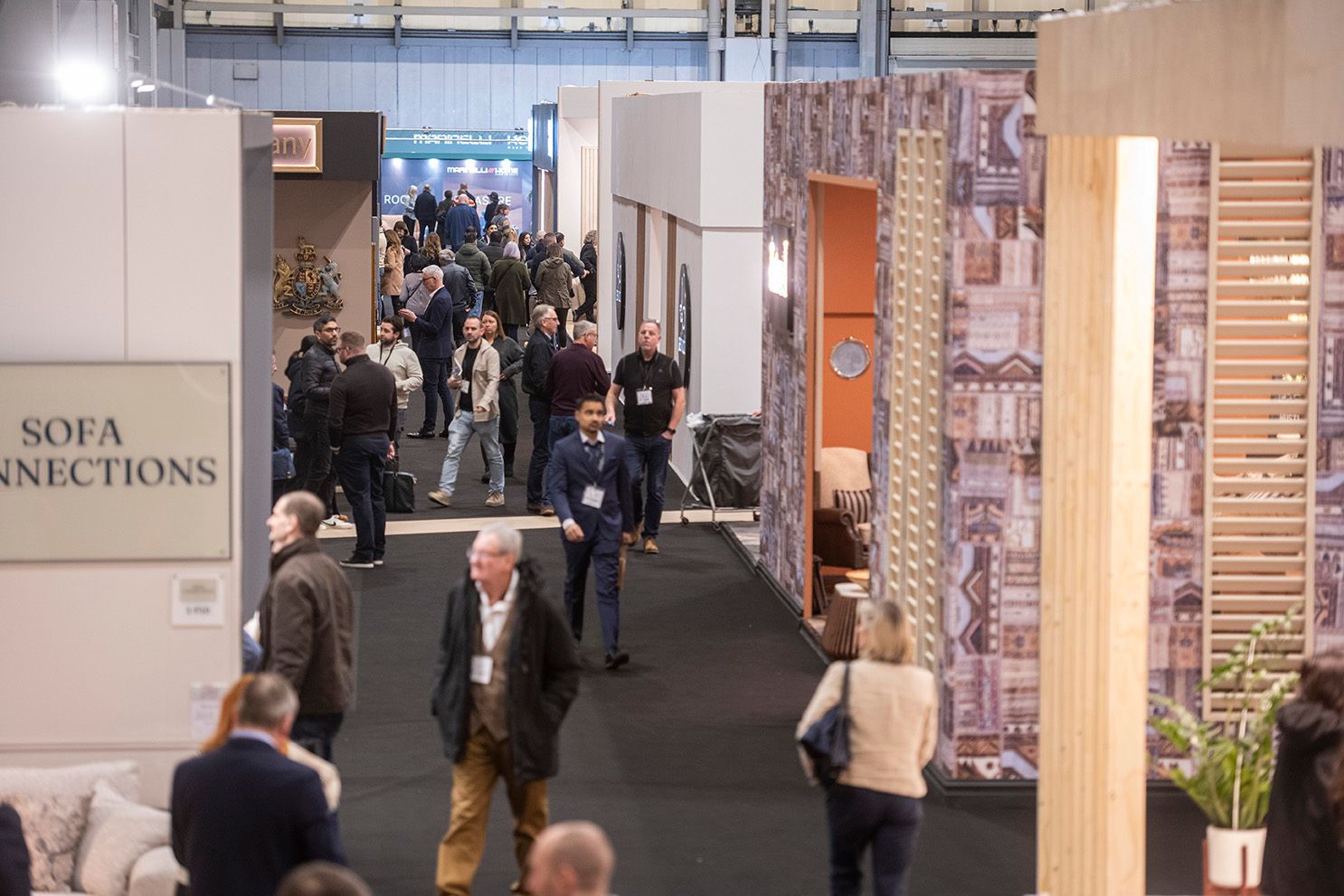

The January Furniture Show (JFS) acts as a live case study for this transformation. The 2025 edition revealed how data-driven decisions and supplier collaboration are reshaping operations in real time. “You’ve got to be at the January Furniture Show; it’s crazy not to be here,” said a senior buyer at Trago Mills, highlighting how the show has become the meeting ground for practical solutions and future-ready thinking.

For logistics leaders, the question is no longer whether to adapt but how fast. What should your next move be to stay ahead, automation, partnerships, or a greener fleet? With 2026 set to reward agility and innovation, JFS continues to serve as the sector’s live lab for testing what works and what’s next in the race for a faster, smarter, more sustainable supply chain.

Closing the Labour Gap

The UK furniture sector continues to grapple with a shortage of skilled logistics workers. From upholsterers and drivers to warehouse teams and planners, the skills gap is widening , and with an ageing workforce and fewer apprentices entering the trade, the challenge is structural as much as it is immediate.

Industry bodies such as the British Furniture Confederation are calling for targeted investment in training and a refreshed image of logistics as a modern, technology-led career. With 57% of manufacturers expecting skills shortages to worsen over the next five years, many warehouses are partnering with schools, colleges, and local councils to attract new talent.

Some are finding success by reframing logistics as a high-tech, data-driven profession rather than a purely manual one. Automation is part of that narrative, but as machines take on repetitive work, human expertise in systems thinking, data analysis, and customer coordination is becoming more valuable than ever.

Rising Costs and Supply Chain Disruption

Despite technological progress, financial pressures remain intense. Materials, energy, and transport costs continue to climb, squeezing margins from importers to high street retailers. Brexit-era paperwork and border friction add further complexity, with customs delays and tariffs creating ripple effects across the chain.

The insolvency of Humber Services Ltd earlier this year was a stark reminder of how fragile cash flow can be in a sector where payment cycles are long and disputes costly. For smaller suppliers, it underscored the importance of digital tracking and tighter forecasting to avoid overstocking or delivery bottlenecks.

Resilience now depends on smarter decision-making. Many UK suppliers are investing in predictive analytics and integrated ERP systems to monitor cost fluctuations and manage inventory in real time. The result: fewer surprises, faster responses, and a clearer view of where to allocate resources.

Technology, Automation, and Collaboration

If 2025 was the year of experimentation, 2026 is shaping up to be the year of integration. The most forward-thinking furniture logistics firms are now combining automation, data visibility, and cross-industry collaboration into cohesive strategies.

Automation is filling the labour gap, from robotic picking and packing to AI-powered scheduling that reduces idle time and energy waste. Cloud-based supply chain management tools are giving operators a live view of stock levels, delivery routes, and production cycles, turning fragmented data into actionable insights. Equipment-sharing models are on the rise, allowing smaller importers and suppliers to share warehouse space and delivery fleets, smoothing peaks and troughs in demand.

And with mobile technology linking suppliers, logistics teams, and retailers in real time, the industry is finally achieving the transparency it has long needed. At JFS 2025, several exhibitors showcased solutions designed to bridge these gaps — from AI-assisted route planning to modular warehousing that flexes with seasonal volumes. As one Wayfair manager put it, “There’s no better way to get a pulse of the UK market than the January Furniture Show. The mix of suppliers makes it easy for us. I’m excited about the level of innovation this year.”

Leadership Lessons: Where to Focus Next

So where should furniture logistics leaders direct their attention in 2026? Industry experts agree on four core priorities:

-

Invest in Digital Transformation

Even small-scale automation or data upgrades can yield major gains in efficiency, accuracy, and customer satisfaction. Start where it hurts most, whether that’s forecasting, routing, or returns. -

Collaborate to Build Resilience

Partnerships with local operators, tech providers, and training bodies can spread risk, reduce cost, and strengthen your supply base. Collaboration isn’t just practical, it’s strategic. -

Prioritise People and Skills

Technology can enhance logistics, but people drive it. Competitive pay, clear career paths, and safer, more flexible workplaces are proving key to retention. -

Stay Ahead of Regulation

New standards for emissions, health and safety, and training are reshaping logistics operations. Proactive compliance isn’t just about avoiding penalties, it’s a way to stay commercially agile.

Looking Ahead

The UK furniture logistics sector is at a pivotal moment. The mix of economic pressure, regulatory change, and consumer expectation is forcing businesses to reimagine how they move, store, and deliver. Yet amid the challenges, opportunity abounds.

Those who invest early in technology, nurture their workforce, and collaborate intelligently will not only navigate the turbulence, they’ll define the next era of retail logistics. And as the industry gathers once again at The January Furniture Show 2026, it won’t just be a showcase of furniture design, but a reflection of how the sector’s supply chain is innovating in real time, faster, smarter, and greener than ever before.

Sources Consulted

- United Kingdom Home Furniture Market Size and Share, Mordor Intelligence, 2025

-

UK Furniture Market Size, Share Growth, Trends & Forecast, Verified Market Research, 2025

-

Furniture Logistics Market 2026: A Deep Dive into Trends, LinkedIn Market Analysis, 2025

-

Retail Week special report: Supply Chain 2026, Retail Week, 2025

-

United Kingdom Furniture Market Outlook 2025-2026, Yahoo Finance/ResearchAndMarkets, 2025